Growth financing

Everything you need to know about financing the growth of your company.

Growth financing

Nowadays, small and medium-sized companies have to grow constantly to remain competitive. However, they often lack the necessary liquidity to finance this growth. In such cases, debt can be a solution, but a traditional bank is not always the best choice.

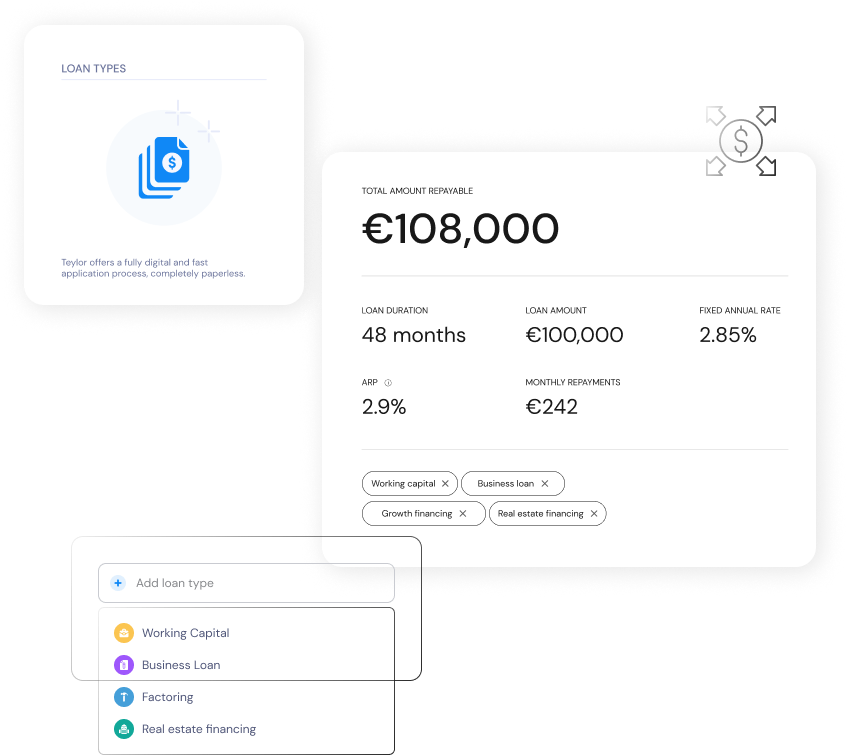

At Teylor, our experts support you with efficient and secure growth financing. We offer unsecured loans between EUR 50,000 and EUR 1.5+ million, fast payouts within two business days and a personalised service. Read on to learn when growth financing is necessary, what solutions are available and what you should consider when growing your company efficiently and quickly.

What distinguishes Teylor growth financing from banks and other lenders?

With Teylor, you benefit from unsecured growth financing and payouts within 48 hours and individual, personalised services. Compared to traditional credit institutions, the application process is simpler and faster. Thanks to fully digital processing, there are no long waiting times and the decision-making processes are shorter compared to traditional banks.

Our customer service experts will give you immediate feedback on your loan application. Personal service and individual advice are essential, which is why your advisor remains your contact person throughout the entire credit process and is available to answer any questions you may have. Your data is protected at all times using the latest encryption methods and a security system in line with banking standards.

A brief definition of growth financing

As part of corporate financing, growth financing supports small and medium-sized companies in their next step towards growth. This involves releasing internal or external expansion plans by providing growth capital that can be invested in additional resources. External capital is usually required, as financing can rarely be provided from existing funds.

Why do you need growth financing?

Growth financing can help small and medium-sized companies to realise their next growth step. But before you consider concrete measures, you should draw up a clear growth strategy and a financing plan.

Ask yourself whether you can manage the growth on your own or whether the acquisition of competitors or joint ventures are the right step. Do you need additional raw materials, storage space or machinery? Do you aim to expand your domestic customer base or export your products?

A realistic business plan in combination with a solid growth strategy is often the prerequisite for growth financing. Financing can be used, for example, to expand the product range, increase production capacity, purchase new machinery or production equipment, set up additional production or sales locations, establish subsidiaries, open additional branches, hire new employees or provide further training and retraining of existing employees.

What options are there for financing growth?

Solid financing is essential for every SMEs that is aiming for growth. But what options are there for financing growth? There is no universal answer to this question, as every company has its own needs. Therefore, SMEs need to carefully consider which financing options best suit their goals. Leasing, Factoring, inventory financing, subordinated financing and hire purchases are some examples that can help companies finance their growth.

Growth financing: How to prepare your loan application

If you are planning to finance growth through a business loan, you should prepare well for the loan application. Before looking for potential lenders, it is important to thoroughly analyse your financial situation and define your goals for growth financing. This is because every lender will obtain information about your company before granting a loan.

You should therefore collect all the necessary documents to prove your ability and willingness to service debt. This includes your company's balance sheet and BWA, documents with a credible track record, investment plans, cash flow calculations and other business data. Liquidity planning for the duration of the loan is also important.

Present the documents in a positive light and, if necessary, seek the support of a tax advisor or ask your experts for advice.

Things to know about credit scoring and collateral

When you apply for a corporate loan, you not only have to submit all the relevant documents and data, but also take your creditworthiness and collateral into account. Lenders check the creditworthiness of your company through a process called credit scoring. They will also consider your provided collateral to minimise the risk of non-payment.

Creditworthiness plays an important role in growth financing, as it shows the likelihood of your company being able to repay the loan. The Crefo score, a creditworthiness index, provides information about the probability of default on your loan repayment. A value between 0 and 250 is considered great, while values between 250 and 299 are still acceptable. A score of 300 or higher is considered poor, while a score between 500 and 600 is considered very poor. Other credit agencies such as CRIFBÜRGEL or SCHUFA can also assess the creditworthiness of companies.

Requirements & Documents

Check the requirements below to see if you are eligible for a loan

What are the minimum requirements?

If you don't meet these minimum requirements, we will not be able to provide you any kind of financing.

The company is registered in Germany

The company's revenue in the last financial year was at least 50,000 €

The company has been active since at least two years

What documents do you need?

You can upload your documents online on our website or send them via email to your financial consultant at info@teylor.com.

The annual reports of the previous two financial years (meaning if you apply in 2022, we need reports from 2021 and 2020)

An up-to-date 'Betriebswirtschaftliche Auswertung' with 'Summen- und Saldenliste (no older than three months)

Bank account statements of the last three months (not older than 14 days)